Tool, Feature, or Product?

A heuristic for venture-backability

Welcome to the eleventh edition of Black Box. Long time no see! Last time, I announced my joining DCM Ventures and a pause on this newsletter. I’m back now that I’ve settled, starting with a question that comes up every day for me. This leads into a three-part series on where I think generative AI is headed, so stay tuned!

One of the first questions I ask myself after meeting a founder is whether they are building a tool, a feature, or a product.1 This seems like a simple heuristic, yet it is often hard to categorize startups in practice. Initially, I thought the whole of this difficulty was inherent to judgement calls. But over time, I saw enough sets of similar companies to realize my calls were inconsistent. I was trusting a gut feeling based on an ambiguous instinctual idea of what these terms meant. To make better calls, I needed to give this heuristic more structure.

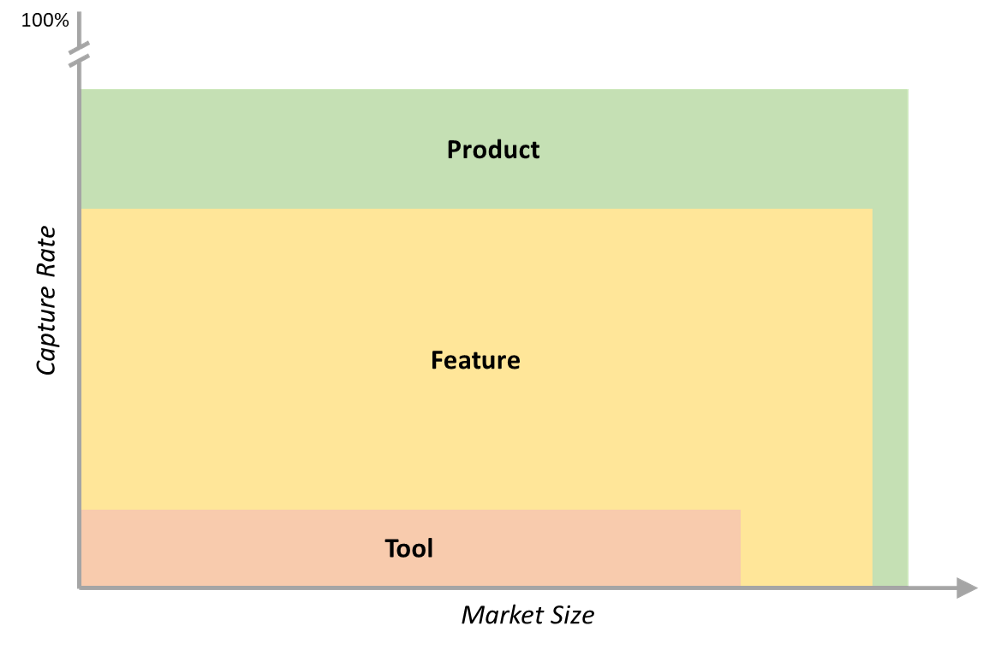

I propose reframing this question as how much value a startup can capture from the utility it creates for what size of market. I mean utility in its economic sense, i.e., the value proposition or functional worth offered by a good or service. The “value” that is captured denotes financial worth, while market size is the number of potential customers. The position of a startup plotted on these three axes decides whether it is a tool, feature, or product.

Any consultant will recognize this as a variation on that mother of all case interview frameworks, revenue equals price times quantity. Here, price is abstracted to worth in general and separated into the customers’ share of utility and startup’s share of value. To make it easier to grok, I like to think of value as the share of functional worth that the startup is able to convert into financial worth.2 Call this the capture rate; replacing the utility and value axes with a capture rate axis collapses the framework into two dimensions for easier visualization.

What I am implying is tool, feature, and product each have a corresponding region on the graph. While I recognize that these regions lie on a spectrum, I think it is useful to conceptualize where they typically fall.3 Here is how I think they roughly sit:

To supplement with a written definition,

A tool is a point solution that is characteristically borderline monetizable. The problems tools address may be very painful, but they are also very narrow, so tool capture rates are low or zero. For example, remove.bg is a tool.

A feature is an incomplete solution that addresses a meaningful but non-core problem under a broader function. Feature capture rates can be quite high initially because it is hard to create a complete solution off the bat or one does not exist yet due to the nascency of the space, but this will erode as the tech matures. Microsoft Paint is a set of features that allow people to alter but not manipulate pictures, so it is not an image editing product.4

A product is a complete solution, or a solution to the core problem plus the set of features needed to fully address the broader function. The incremental value captured from feature to product is less than that from tool to feature because products create disproportionally more utility on an absolute basis. On the other hand, product capture rates are more defensible because complete solutions are hard to replicate. Photoshop is a product.

As the graph suggests, most startups are building features. Should VCs ignore all of them and only back products? In theory, yes; but in practice, this is unrealistic. A feature can be a sound investment as long as both the investor and the founder intend the feature to be a wedge into a product. That means the investor must

Recognize the broader function to which the feature belongs. This can be clouded by good storytelling on the founder’s part suggesting that the current state is already a product.

Suss out whether the founder recognizes the broader function and has ideas about what the product might look like. Storytelling is one thing, but if the founder actually doesn’t realize they are building a feature, there is a bigger problem. The investor can test this by asking about their vision for the company.

Understand the founder’s pathway from feature to product. The investor can test for this too by asking how the founder plans to use their current traction, the hypotheses they have, and the experiments they want to do to test them.

Of course, this framework is just a facet of the investment decision. One of the first pieces of advice I got in VC was “the analysis is the easy part”, and I am reminded everyday of how much of investing is trust and feel. But since that is the case, it’s all the more important to get at least the analysis right. I think refining this heuristic has made me a better analyst. Maybe it will be helpful for you too. ∎

I’m curious how other VCs think about this question. Feel free to tweet me @jwang_18 or reach out on LinkedIn. See you in two weeks!

I wrote about why this question is important in an earlier post.

At the market-clearing price, the capture rate should be less than 100% since customers would otherwise receive less worth than they gave to purchase the good or service and no transaction would take place.

Products in the bottom right corner — large market size but low capture rate — are interesting from an investment perspective. They may be good early stage investments (thanks to greater fools) but poor late stage and especially public investments (due to limited cashflow). Luckily, this set is vanishingly small because there are very few markets large enough to compensate for the low capture rate. Twitter is perhaps the most visible example, and its capture rate is being “improved” right now.

Strictly speaking, Paint is not a feature either since it is free as part of Windows and therefore has a capture rate of zero. Pretend Microsoft charges for it (which is does, just indirectly).

Really cool and thought-provoking article! Curious to hear more about the criteria for evaluating a product vs. feature from a VC's perspective

Welcome Back! It is always amazing to hear your thoughts on these things. It is always done with such thought in care.

When I thought about Tool/Feature/Product, I always thought about it from a position of defensibility rather than a dimension of market size. For example, a lot of AgTech companies are coming out with "Products"- think IoT Cow collars, microbial fertilizer or pesticides, and autonomous drones. They have fit the criteria you outline but I suppose their niche or market size is inherently constrained so they will forever be considered tools.

There are Boutique VCs out there that make a ridiculous sum of money purely investing in products that many would consider tools. It isn't that I disagree with your framework, but I wanted to hear your thoughts about whether the conversation we VCs have about Tools/Feature/Product is a unique rub of later stage fund like my own and funds like yours that exclusively look at companies with supposedly infinite growth potential.

Appreciate the thought provoking read as it makes me reflect on how little my firm actually discusses these topics. But it makes me think about how few companies in the world are actually products and how challenging it is as a VC to pinpoint a companies' SAM/TAM.